Stock averaging down calculator

Stock Profit Calculator is the best calculator to calculate net profits after the commissions you incur for buying and selling for your return on investment. The average stock market return over the long term is about 10 annually.

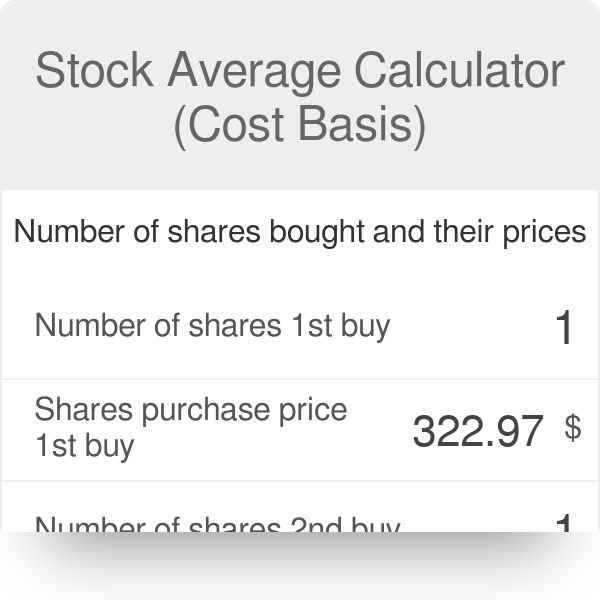

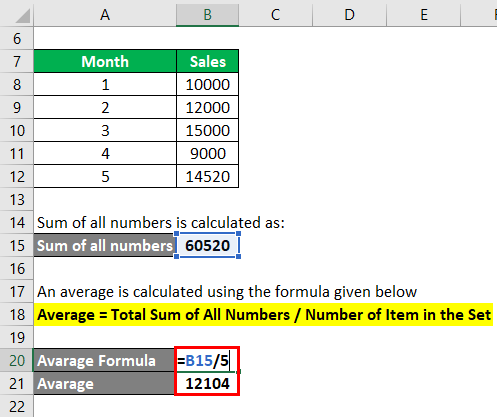

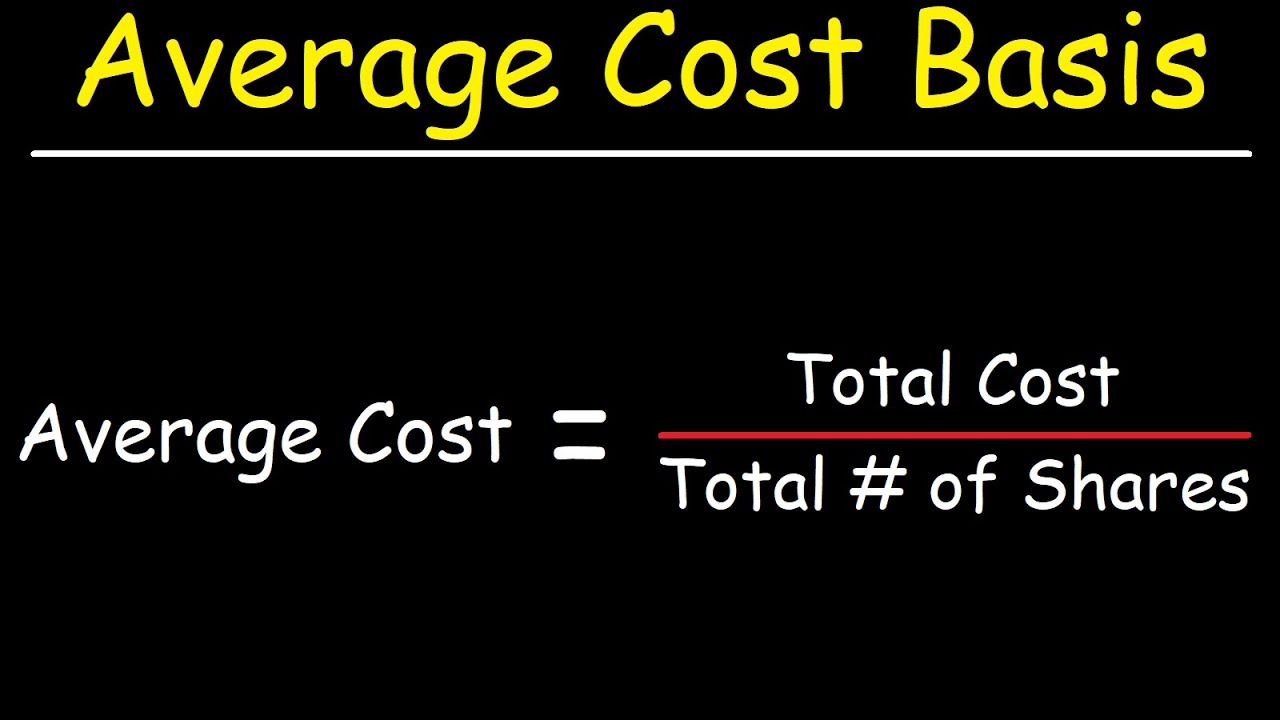

Stock Average Calculator Cost Basis

Down from 415 for new and 882 for used.

. I remember wondering why the various subjects covered were not taught or at least mentioned when I was at school. The shares are going higher and usually an uptrend will be sustained if the underlying company is doing well. The underlying security may be a stock index or an individual firms stock eg.

Futures and options are the main types of derivatives on stocks. 2 Average cost basis is important because it impacts the net income calculation and profitability figures. Whichever it is it is all up to you this calculator simply helps you compute the stock average if you are planning on buying more stocks at the dip.

CAGR of the Stock Market. This dca calculator stock strengths your financial strategy. That was in 2014.

To increase your salary as a data scientist consider the following options. Stock futures are contracts where the buyer is long ie takes on the obligation to buy on the contract maturity. Noel I read Making Money Made Simpl e in 1987 when I was 27 and couldnt put it down.

In contrast to averaging down averaging up is often a more effective strategy. The best stock trading apps. Wouldnt you rather buy shares at 150 apiece than 200 apiece.

Much of the. Financial StockShare Market Personal Finance and Investing Definitions and FQ. If the price of the underlying asset is below the strike price the gain is the difference between the strike price and current price of the.

Social networking companies like Google and Facebook often pay premium salaries for data scientists as do financial organizations or manufacturers. You are never buying the stock right at its peak or at its low with dollar-cost. How to Use The Stock Average Down Calculator.

SIP stands for Systematic Investment Plan wherein you can regularly invest a fixed amount at periodical intervals and aim for better benefits over a period of time through. If an investor makes a purchase and the shares start climbing they have been proven right about their trade. Averaging down when purchasing stocks is a great way to bring your purchase down during market volatility if you really believe in investing in the companys future and their.

Using Bankrates auto loan calculator Insider calculated how much a borrower paying the average interest rate would. That was in 2014. Source and Methodology of the Exchange Traded Fund Total Return Calculator.

We originally built a version of this stock total return calculator for DQYDJs five year anniversary and 749th published article. Whats your investing strategy. This SIP calculator is an investment calculator that shows the amount of money you need to invest based on the goal amount you wish to achieve within a particular time frame.

But the ratio of the company is up and down. The average cost basisbase value is purchase price minus accumulated depreciation for purchased breeding stock. Dollar cost averaging is a strategy that can help you lower the amount you pay for investments and minimize risk.

So lets say theres a stock you want to invest in and hold for the next 20 years. Now this is not 100 accurate. For example if you had an investment that went up 100 one year and then came down 50 the next you certainly wouldnt say that you had an average return of 25 100 - 502 because your principal is back where it started.

Most of the traders do not recommend averaging down while investors may want to do it. If the stock price recovers to the 1st purchase price of 5000 the total value of the investment will become from. This investor will invest the same amount every time he plans to invest.

People generally invest one of two ways. This latter method called dollar cost averaging may. A stock derivative is any financial instrument for which the underlying asset is the price of an equity.

For periodic windfalls you receive we prefer investing the lump sum all at once. The dollar cost averaging calculator UK is very beneficial. Dollar cost averaging is our preferred normal style of investing where you invest on a regular basis.

The buyer of the put option expects the price of the underlying asset to go down. Instead of purchasing shares at a single price point with dollar cost averaging. Be informed and get ahead with.

Your real annualized gain is zero. The ETF return calculator is a derivative of the stock return calculator. We suggest using an average annual return of 6 and understanding that youll experience down years as well as up.

A put option gives the buyer the right but not the obligation to sell an underlying asset at the strike price on or before the maturity date. DRIPs use a technique called dollar-cost averaging intended to average out the price at which you buy stock as it moves up or down over a long period. The Most Comprehensive Investing Glossary on the Web.

For raised breeding stock it is the base value of the animal the cost of raising the animal to that stage eg. Estimate the dividend and growth yield of your investment with a few clicks. This changes the cost basis from 5000 to 3000 which is a difference 2000 or 4000.

Averaging down can be an effecive stock market investing strategy when you believe the price will move higher. Years into the tool and even more into some of our others we continue to stress that you need to produce fair dividend reinvested return comparisons when discussing investments. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Easy to use dividend calculator. Consider changing to an industry that is more competitive and willing to pay higher salaries. With a lump sum purchase or in smaller steady amounts over time.

So investors plan a time duration of 6 months and invest 1000 each month in order to get profit. This calculator lets you find the annualized growth.

Stock Total Return And Dividend Calculator

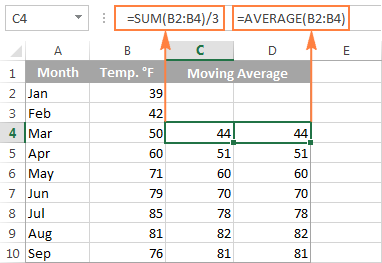

Moving Average In Excel Calculate With Formulas And Display In Charts

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

Stock Calculator

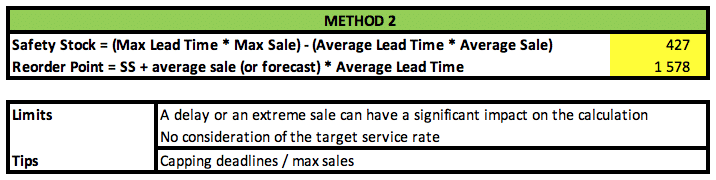

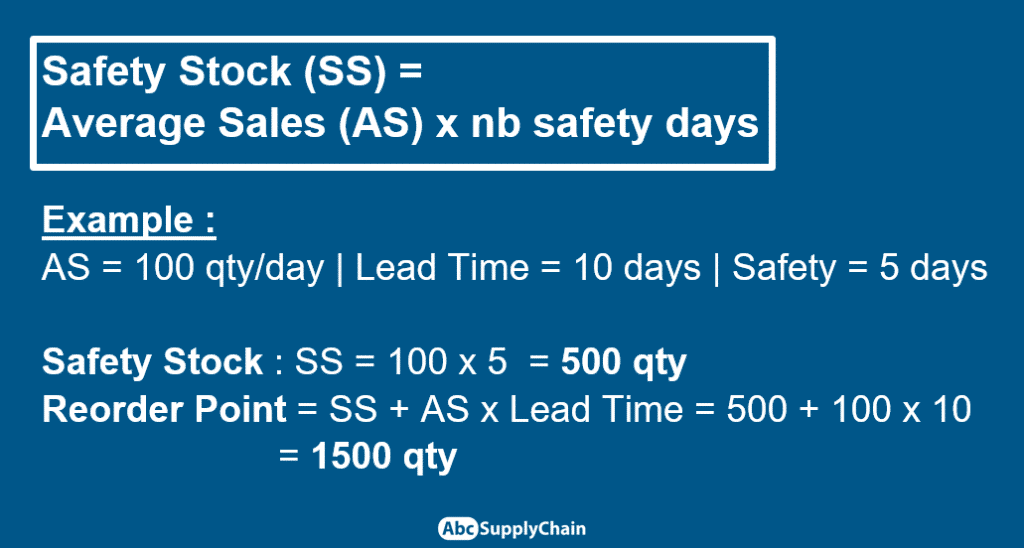

6 Best Safety Stock Formulas On Excel Abcsupplychain

Stock Average Calculator India By Financex

Average Formula How To Calculate Average Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

6 Best Safety Stock Formulas On Excel Abcsupplychain

How To Use The Safety Stock Formula A Step By Step Guide

Average Cost Calculator Crypto Stocks Forex Trading

Stock Average Calculator Cost Basis

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

6 Best Safety Stock Formulas On Excel Abcsupplychain

Average Cost Calculator Crypto Stocks Forex Trading

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition